Data is quite possibly the most valuable business asset. Information from various business departments accumulates over the years and tells the story of an organization. It can provide invaluable insights into the future of that business and requires the utmost care in storage and management. In many cases, the various data from each entity is stored separately and in different formats, making it cumbersome, unmanageable, and overwhelming.

Challenges in the Dataverse

The rate of data among enterprises is growing at a rate of 40-60% each year. This rapid expansion makes the storage, management, and utilization of that data more and more challenging and can greatly affect growth. Hindrances to the effective use of data include siloed data sources, a shortage of experts who can analyze big data, extracting meaningful insights that lead to actionable intelligence, as well as the security of data.

“Data-driven companies are those with a certain data maturity and literacy across the organization, where employees value the power of data,” explains Ashish Tamboli, EPM Senior Consultant at Caravel. Tracking, reviewing, and analyzing data and trends over time can greatly help organizations to better understand which processes need to be fixed and which are performing well. Data helps leadership create strategy based on evidence and to better understand customers—where they come from, what propels them to buy, and perhaps why certain items have high return rates. Simply put, having organized data helps businesses make more informed decisions, improves customer relationships, and increases revenue.

What is NSAW?

NSAW, or NetSuite Data Warehouse, is a cloud-based data storage and analytics solution for NetSuite ERP users that marries data and analytics along with AI and Machine Learning (ML). This allows users to speed up their decision-making processes and convert them into actionable results. NSAW employs the power of the Oracle Analytics Cloud, which is backed by the Oracle Autonomous Data Warehouse. This allows users to build and run analyses and visualizations quicker and without the need for their IT department.

Effectively solving data management challenges, NSAW brings together ALL data sources, including NetSuite Finance and Operations data, and other sources a business may use such as Shopify data, Salesforce data, Google Analytics, and many more that allow a business to turn off legacy systems that no longer serve it. NSAW also reduces the heavy task of migrating data and offers self-service analytics and automated reporting from multiple sources.

NSAW allows its users not to look at data in isolation, but rather from an entire workflow perspective to more easily identify patterns, understand what the data is revealing, and make true, data-driven decisions.

NSAW propels businesses to make faster, more cost-effective decisions by:

-

- Streamlining data management and ease of access.

-

- Fast-tracking business insights and solving business challenges.

-

- Reducing IT costs and complexity.

-

- Eliminating reliance on spreadsheets.

-

- Giving direct access to historical data.

-

- Simplifying reporting by eliminating the need for presentations.

AI Capabilities

The power of artificial intelligence drives NSAW to validate, centralize, and connect sources of data from unrelated operational systems, thereby granting access to the most up-to-date data that is consistent and whole. This reduces human error, as well. Always on the job and running in the background, it allows for speedier insights and produces a clear look into financials and operations by utilizing pattern recognition, outlier detection, automatic forecasting, and predictive modeling. AI makes analyzing trends and creating reports based on the most current and historical data. By processing large data sets from multiple sources, NSAW reveals the value that would otherwise be buried by legacy systems.

How Historical Data Adds Tremendous Value

Historical data is classified as past (pre-NetSuite migration) ERP transactional information on sales, products or services, customers, and suppliers. Businesses are required to retain this information for financial and legal purposes, and it’s typically stored in siloed, legacy in-house systems with restricted access to preserve its integrity. This data is rich with information and lessons from historical operational performance as well as the customer and explains a lot about current facts and figures. It also plays a large role in forecasting, which allows businesses to plan for change.

Money is spent to safeguard, monitor, update, and patch this data – and this requires expertise to guard it against security threats. Over a seven-year period, these costs add up. This is where a centralized, cloud-based system can eliminate all the issues that segregated and costly historical data causes.

Benefits include:

-

- A single source of truth for all business transactions.

-

- Secure, reliable, and accessible data.

-

- Direct access to historical data.

-

- Ease of use out-of-the-box for immediate results.

-

- Multiyear trend reporting alongside current data, allowing for cause-and-effect analysis.

-

- Solid customer data, allowing businesses to identify pertinent information on loyal customers.

-

- Viewable multiyear purchase trends that blend historical data with current eCommerce data.

-

- Website and CRM data blended with historical data to reveal more about customer acquisition, which is important for retention.

Unsiloed Data is Powerful Data

One of the biggest challenges that businesses face is having their data in silos as well as in many different formats. Getting access to their data is yet another issue they face, while the struggle with manual fatigue is next on the list. The cost implications of managing legacy data are an additional problem, but all these issues can be easily solved.

Many NetSuite users have other systems and data sources within their organization that could offer tremendous benefits by adding additional context and a more thorough understanding of the past, present, and future. This diverse data can help detect early signs of change, allowing businesses to be more agile and adaptable.

Sources of internal data include:

-

- Marketing and social media campaign data

Sources of external data include:

-

- Google search and Google ads data

-

- Social media sentiment on competition

All this highly valuable data isn’t being shared across the business, and as it accumulates, it gets stale if unused.

There are many ways that data silos waste resources and reduce employee efficiency. According to Stitch Data, it can reduce the speed at which a company uses data to make decisions, permit poor collaboration among departments, incur unnecessary IT costs, and reduce the quality of data, thereby leading to poor analytics.

Centralizing data will unlock tremendous value and allow the business to safely retain the data and allow for access across departments, retire legacy systems that no longer serve a purpose, be rid of costly data migration projects, and allow for analysis of operations, trends, and performance over time.

Data storage scales according to a business’s needs and NSAW offers over 40 pre-built connections to sources such as Google Analytics, Shopify, payroll data, inventory data, HR data, Salesforce, and more. The challenges of integrating and managing data are minimized so users can focus on unveiling valuable insights that lead to more informed business decisions.

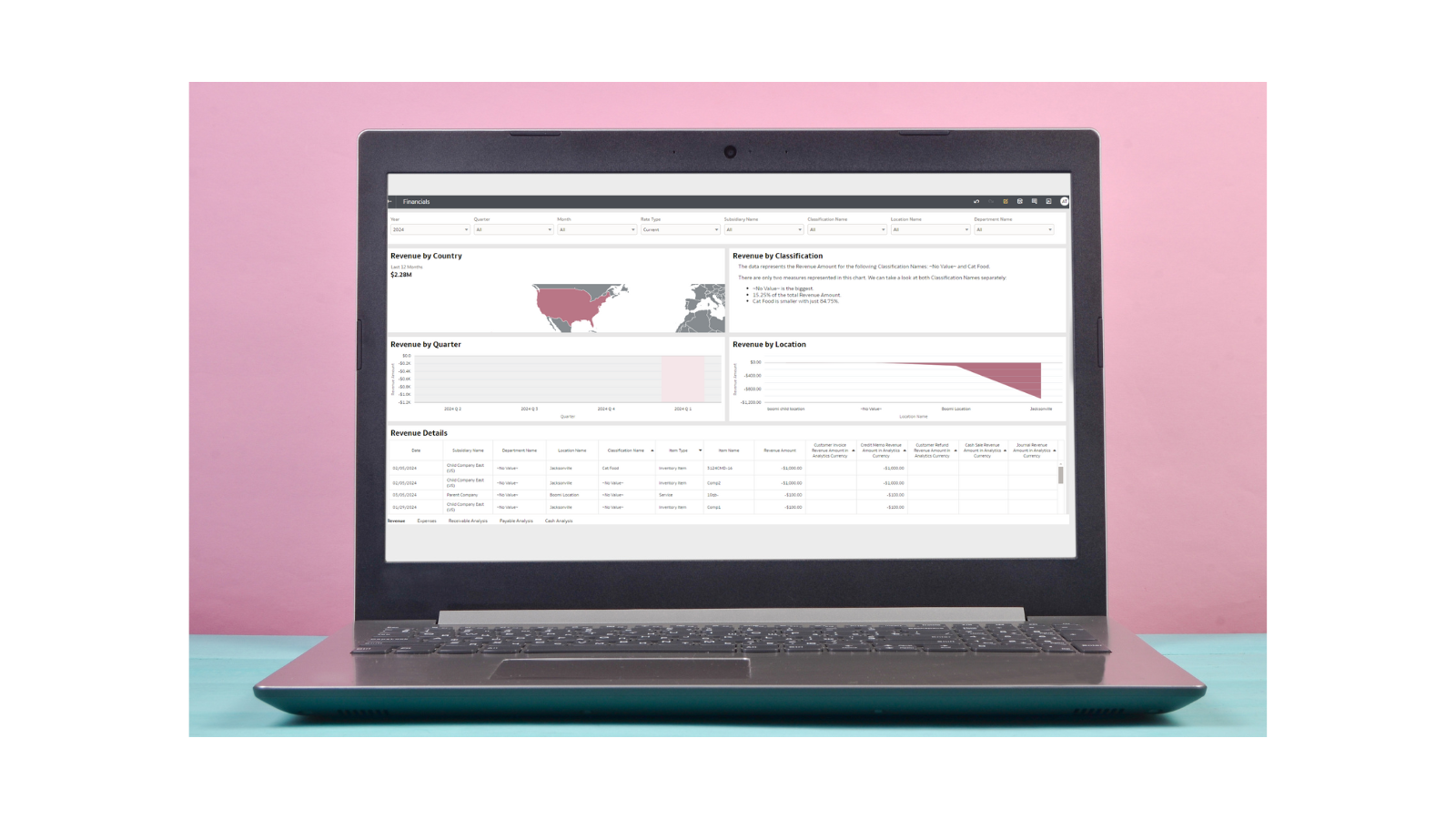

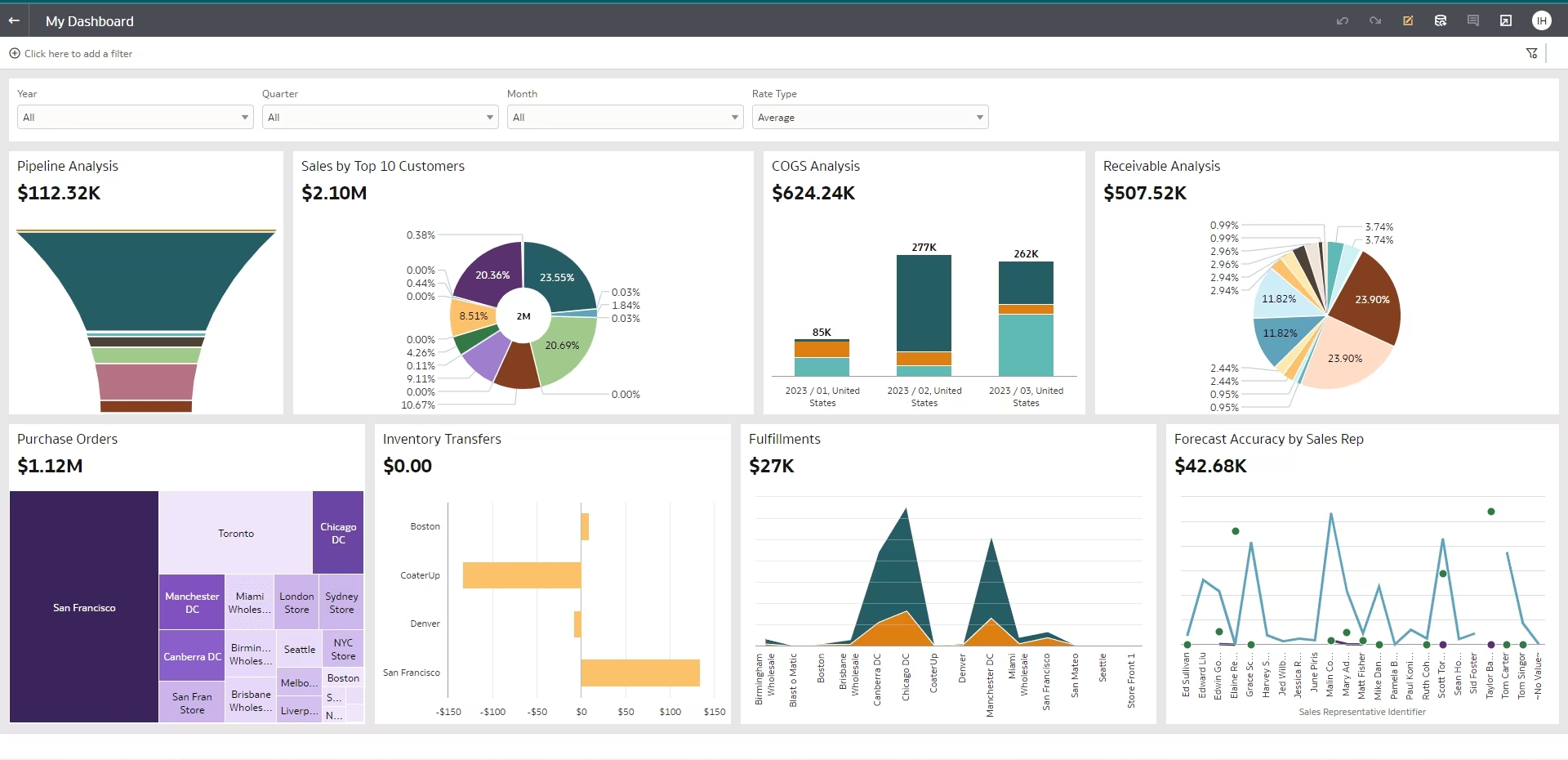

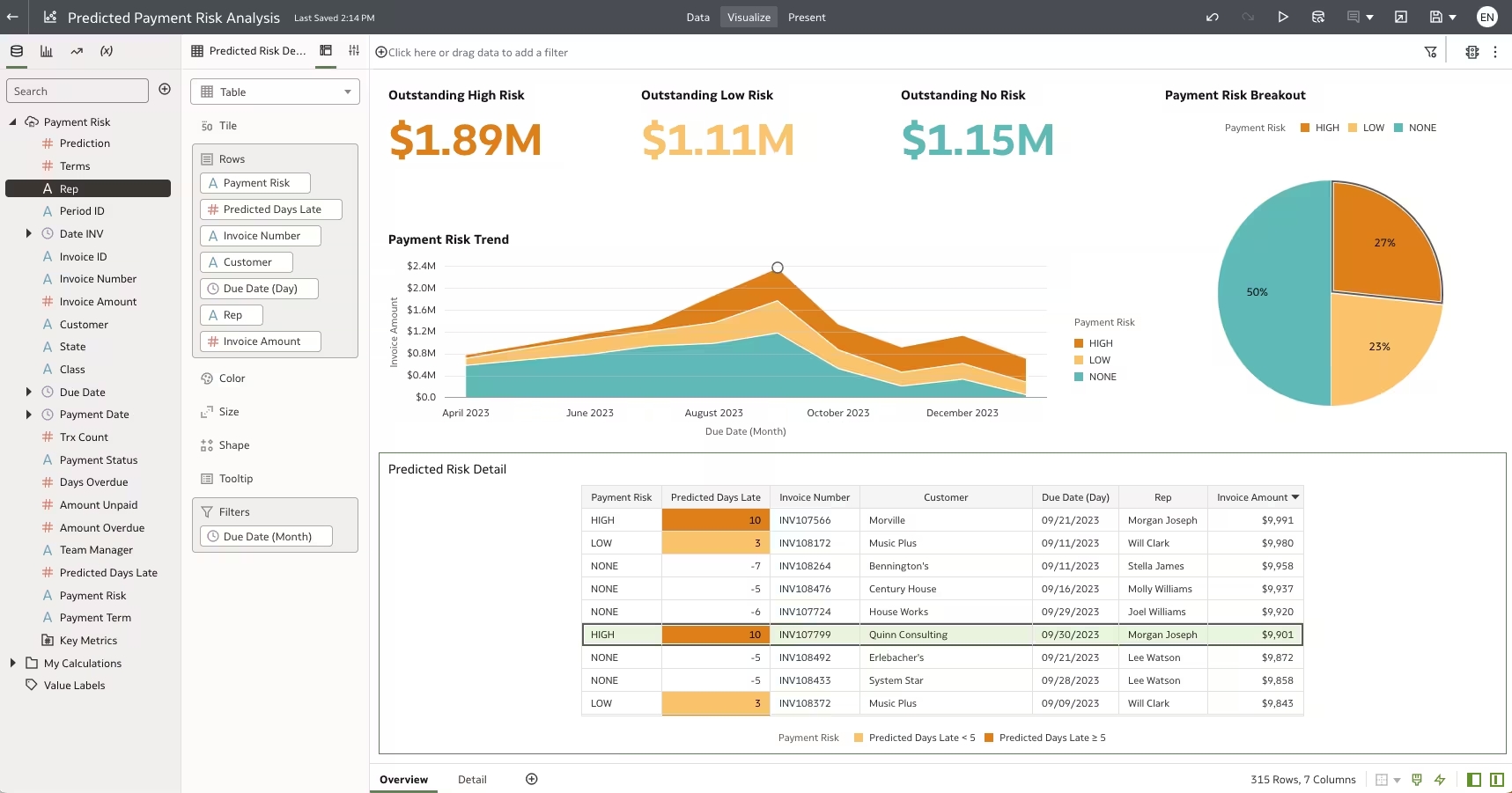

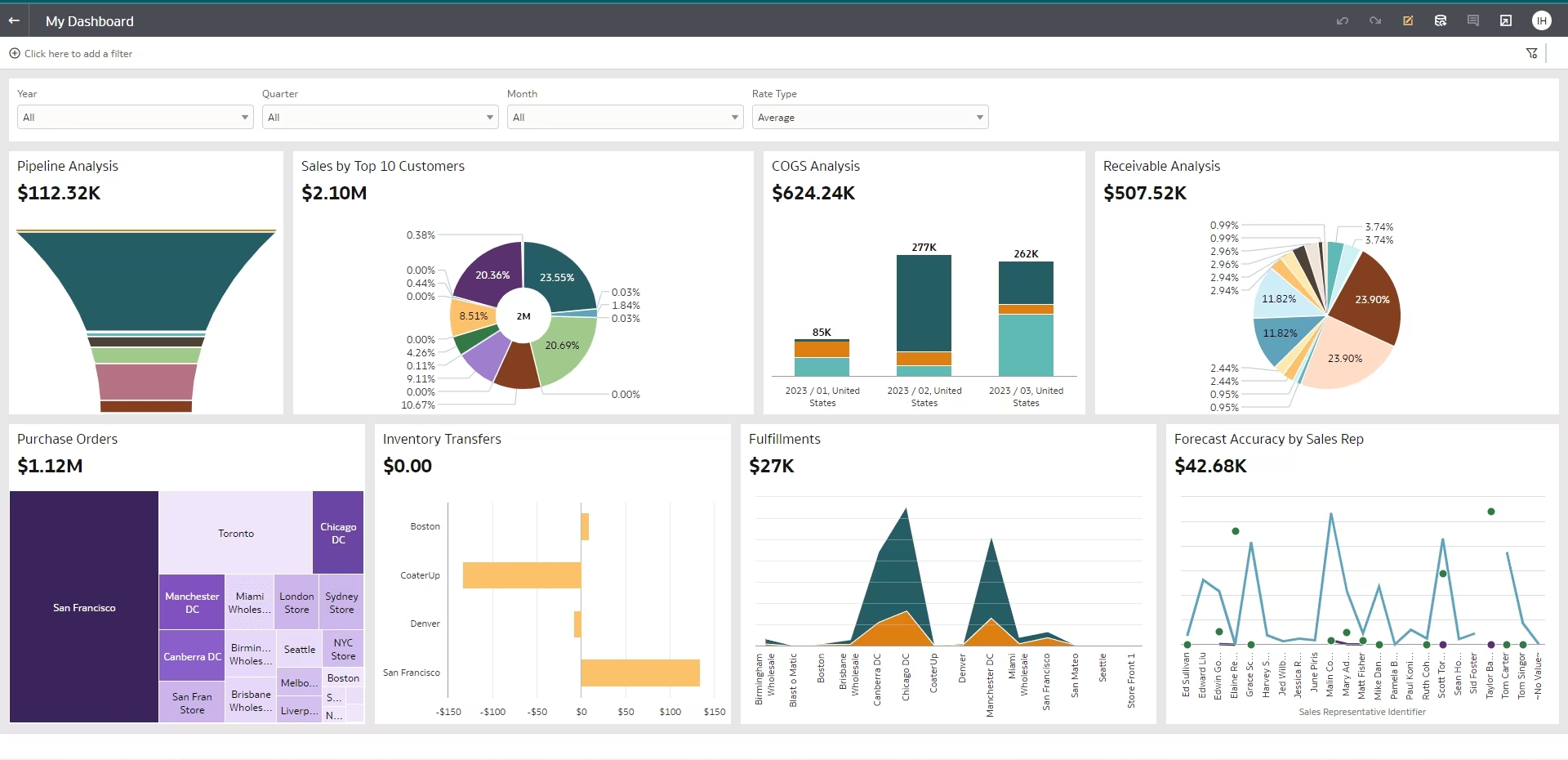

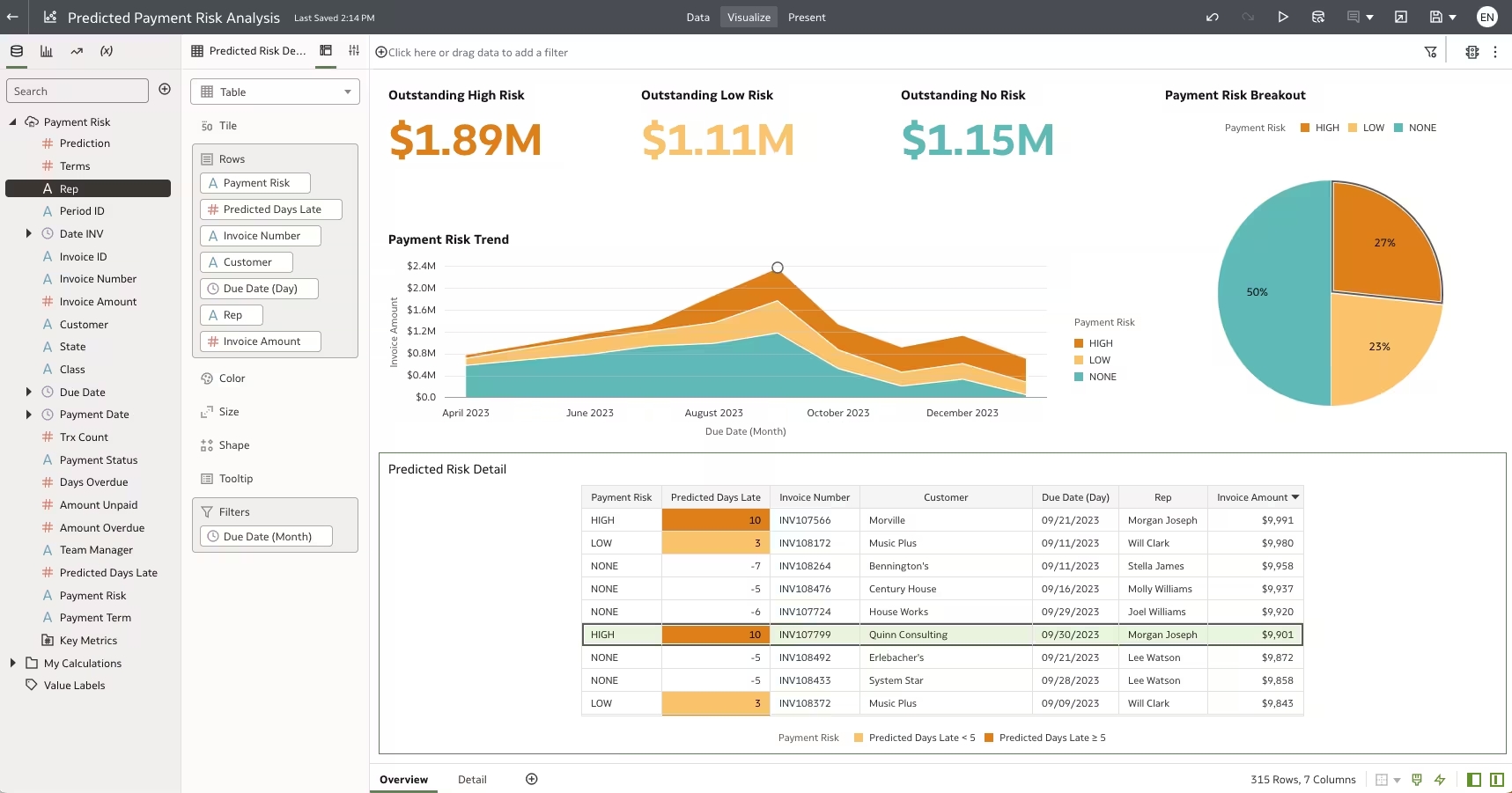

The visualizations and dashboards are comprehensive and easy to understand, while using the built-in ML models allows for predictive analysis.

Painless Reporting

Manual reporting is an effort of the past. With NSAW, self-serve reporting is easy, with drag-and-drop features and a collection of visually appealing dashboards that offer key metrics from all over. Sales, inventory, financials, procurement, and more—these dashboards are easily customizable and offered in everyday language, making it simple. Meanwhile, AI runs in the background and offers features such as auto recommendations on the optimal visualization styles, helping to interpret results more quickly. Reports refresh themselves automatically, so the user is not constantly rebuilding them. No-code forecasting allows users to better plan and predict for the future. All this is presented on one screen, avoiding users jumping around to uncover inefficiencies and discover revenue opportunities.

NSAW offers KPIs and metrics for many different job roles, putting them in the proper context for each employee. This role-based analytical capability makes it simpler for users to view what is relevant to them. It also allows users to drill down from KPIs and charts and investigate elements at the transaction level. Its reporting capabilities reduce time spent on creating presentations by offering visuals that can directly export to various formats such as PDF, PNG, and XLS.

Spotting Key Revenue Drivers

One of the driving values of NSAW is cost savings. As a data migration solution, being able to store and access historical data without having to pay for other licenses is tremendous on the bottom line. NSAW, compared to other solutions on the market, allows current NetSuite users to save tens of thousands of dollars a year by consolidating their data in the warehouse.

“NSAW is a strategic investment for data-driven companies to gain valuable, immediate, and accurate insights, Ashish states. “Since many employees lack IT knowledge, NSAW acts as a self-serve tool that can be used with little to no IT support by leveraging pre-built datasets and reports.” This is where significant cost savings come in and eliminate the need for complete IT support, making users more autonomous and able to gain insights and delve into trends without relying on IT.

Once data has been effortlessly merged into NSAW and is centrally packaged with easy access, users can easily solve business problems and make more informed decisions. Running autonomously in the cloud, a prebuilt data pipeline automates the flow of NetSuite ERP data into the Warehouse (daily or at other frequencies); automations organize the data so it’s usable and accessible—thereby eliminating the need for an IT team to run it. As Ashish points out, “NetSuite ERP is not enough of a system to give you insights into your data. Users need to have the capability to slice and dice data to get more meaningful outputs and compare trends. This is where NSAW comes in and allows users to compare trends over time.”

NSAW consolidates information and centralizes assets, giving relevant data to end users—anytime, anywhere.

Caravel can help accelerate the implementation of NetSuite’s Analytics Warehouse so that your teams can all be on the same page when it comes to data and insights.

Watch the on-demand webinar, Harnessing the Power of Your Analytics With NSAW, and learn more about this extraordinary program that will propel your organization to the next level.