The global trade landscape is experiencing significant disruption in 2025, with recent tariff changes creating waves across supply chains worldwide.

These tariff increases have created an average tax increase of nearly $1,300 per U.S. household in 2025, according to the Tax Foundation. For businesses that rely on international suppliers, the impact is even more dramatic:

- Higher landed costs affecting profit margins

- Disrupted supply chains and delivery timelines

- Increased compliance requirements and documentation

- New pricing pressures from customers resistant to absorbing the costs

For CFOs and operations leaders, this rapidly changing trade environment demands nimble responses and strategic planning. Companies need systems that can provide real-time visibility into tariff impacts and help model various scenarios to maintain profitability.

According to NetSuite, the cloud ERP market is expected to grow from $72.2 billion in 2023 to $130.5 billion by 2028, with the volatility of international trade being a key driver of adoption (NetSuite, 2025). Gartner reports that less than 5% of clients now express interest in acquiring or maintaining on-premises ERP solutions, as cloud platforms offer greater agility in responding to disruptions like tariff changes.

Leveraging NetSuite for Tariff Visibility and Control

If you’re using or considering NetSuite ERP, there is built-in functionality that will help you navigate this disruption.

Setting Up Accurate Landed Cost Tracking

NetSuite’s Landed Cost functionality serves as the foundation for effective tariff management. This feature allows you to:

- Track all costs associated with bringing products into inventory

- Create specific landed cost categories for different types of tariffs and duties

- Automatically calculate the true cost of imported goods based on weight, value, or quantity

- Incorporate these costs into your inventory valuation and pricing strategies

By setting up NetSuite to track tariffs as a specific landed cost category, you gain visibility into exactly how these charges affect your product costs. This is critical for maintaining accurate margins and making informed decisions about pricing adjustments.

Using Procurement and Vendor Management Tools

NetSuite’s procurement and vendor management capabilities allow you to strategically respond to tariff changes:

- Diversify your supplier base across different geographic regions to minimize tariff exposure

- Compare landed costs, including tariffs, across multiple vendors

- Implement automated approval workflows that flag orders with excessive tariff impacts

- Track country of origin for all components and finished goods to ensure compliance

These tools help businesses quickly pivot sourcing strategies when tariff policies change, potentially saving substantial costs through strategic supplier selection.

Automating Alerts Based on Tariff Thresholds

Staying ahead of tariff impacts requires proactive monitoring. NetSuite can be configured to:

- Establish cost thresholds that trigger automatic alerts

- Create dashboards displaying products most affected by tariff changes

- Implement workflows that route high-tariff purchases for additional review

By automating these monitoring activities, your team can focus on strategic responses rather than manual cost tracking.

Protecting Margins with Better Planning and Forecasting

In an environment where tariffs can change rapidly, scenario planning becomes essential for maintaining profitability. NetSuite Planning and Budgeting (NSPB) provides powerful tools to model different tariff scenarios and their impact on your business.

- Integrate real-time tariff data with financial forecasts to maintain accurate margin projections

- Collaborate across departments to create unified response strategies to tariff changes

- Generate automated alerts when tariff-impacted products fall below target margin thresholds

Modeling Different Tariff Scenarios

NetSuite Planning and Budgeting allows you to create multiple “what-if” models to understand the potential impact of tariff changes:

- Simulate the financial impact of various tariff levels on your product portfolio

- Forecast cash flow impacts under different trade policy scenarios

- Evaluate the costs and benefits of reshoring production

According to a recent Gartner report, companies that implement robust scenario planning capabilities are 35% more likely to outperform their peers during market disruptions.

Adjusting Pricing and Margin Targets

With accurate cost data feeding your forecasts, NetSuite enables you to make strategic pricing decisions:

- Automatically update product pricing based on landed cost changes

- Segment your product catalog to identify items where price increases can be passed through

- Create time-phased pricing strategies to gradually adapt to tariff changes

- Set margin thresholds that trigger automatic pricing reviews

These capabilities help maintain profitability without resorting to across-the-board price increases that could harm customer relationships.

Final Thoughts: A Proactive Stance in an Uncertain Trade Environment

The current tariff environment represents a fundamental shift in global trade dynamics rather than a temporary disruption. Forward-thinking companies are using this challenge as an opportunity to build more resilient and transparent supply chains.

- NetSuite provides the tools needed to navigate this complexity, offering:

- Real-time visibility into the true costs of goods, including tariffs and duties

- Flexible planning tools to model various trade scenarios

- Automated workflows to ensure compliance with changing regulations

- Strategic insights to inform sourcing and pricing decisions

Is your organization prepared to adapt to the new tariff reality? Now is the time for CFOs, COOs, and controllers to evaluate their ERP systems’ readiness to handle these complex requirements. Companies with integrated systems like NetSuite are better positioned to turn tariff challenges into competitive advantages through superior cost visibility and strategic planning.

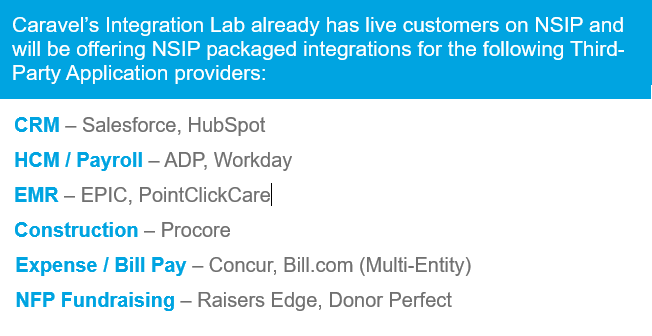

How Caravel Can Help

Caravel offers strategic guidance and support to help businesses navigate tariff complexities using NetSuite. As a multi-year NetSuite Partner of the Year (2020-2024), our team provides comprehensive services to optimize your NetSuite configuration for effective tariff management.

Our expertise includes:

- Setting up and optimizing NetSuite Landed Cost tracking for tariff management

- Configuring Planning and Budgeting modules for scenario planning

- Developing custom reports and dashboards for tariff impact analysis

- Training your team on best practices for managing tariffs in NetSuite

- Ensuring compliance with international trade regulations

Whether you need to implement NetSuite for the first time or optimize your existing system to better handle tariff impacts, Caravel provides cost-effective packages tailored to your specific needs.

Contact Caravel today to ensure your business is prepared to maintain margins and compliance in this challenging trade environment.